Constitutional amendments on the ballot Nov. 5

The Texas Constitution is the second longest state constitution, at 86,936 words, behind only Alabama’s 388,882-word constitution. The Texas Legislature wants to make it a bit longer and has proposed adding 10 more amendments to the 498 already tacked on to the original Constitution adopted in 1876.

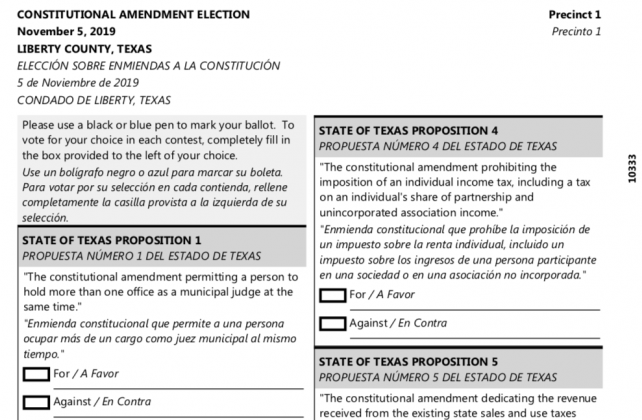

An election will be held Nov. 5, with early voting starting Monday, Oct. 21, and the tiny percentage of the public who will turn out for it will decide for everyone else which of the following is to become a part of this state’s basic law. Immediately below are the summaries of the proposed amendments as they will appear on the Nov. 5 ballot. Following those, for the benefit of our readers made of sterner stuff, are the actual amendments themselves:

PROPOSITION 1

“The constitutional amendment permitting a person to hold more than one office as a municipal judge at the same time.”

PROPOSITION 2

“The constitutional amendment providing for the issuance of additional general obligation bonds by the Texas Water Development Board in an amount not to exceed $200 million to provide financial assistance for the development of certain projects in economically distressed areas.”

PROPOSITION 3

“The constitutional amendment authorizing the legislature to provide for a temporary exemption from ad valorem taxation of a portion of the appraised value of certain property damaged by a disaster.”

PROPOSITION 4

“The constitutional amendment prohibiting the imposition of an individual income tax, including a tax on an individual’s share of partnership and unincorporated association income.”

PROPOSITION 5

“The constitutional amendment dedicating the revenue received from the existing state sales and use taxes that are imposed on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission to protect Texas’ natural areas, water quality, and history by acquiring, managing, and improving state and local parks and historic sites while not increasing the rate o f the state sales and use taxes.”

PROPOSITION 6

“The constitutional amendment authorizing the legislature to increase by $3 billion the maximum bond amount authorized for the Cancer Prevention and Research Institute of Texas.”

PROPOSITION 7

“The constitutional amendment allowing increased distributions to the available school fund.”

PROPOSITION 8

“The constitutional amendment providing for the creation of the flood infrastructure fund to assist in the financing of drainage, flood mitigation, and flood control projects.”

PROPOSITION 9

“The constitutional amendment authorizing the legislature to exempt from ad valorem taxation precious metal held in a precious metal depository located in this state.”

PROPOSITION 10

“The constitutional amendment to allow the transfer of a law enforcement animal to a qualified caretaker in certain circumstances.”

FULL WORDING OF PROPOSED AMENDMENTS

Those are the summaries of the proposed amendments as they will appear on the Nov. 5 ballot, only the ballot will have longer headings above each. Below is the wording of the actual amendments themselves, each passed as either a House Joint Resolution or a Senate Joint Resolution. Underscored words are proposed additions. Words struck through are proposed deletions. Where no words are underscored or struck through, the entire passage is a proposed addition to the Constitution:

PROPOSITION 1

H.J.R. No. 72 and would amend Sec. 40, Art. XVI by adding Subsection (e) to read as follows:

(e) Notwithstanding Subsections (a) and (c) of this section, a person may hold more than one office as an elected or appointed municipal judge in more than one municipality at the same time if the person receives no salary or compensation for any office of municipal judge held by the person.

PROPOSITION 2

S.J.R. No. 79 and would amend Art. III by adding Sec. 49-d-14 to read as follows:

Sec. 49-d-14. (a) In addition to the bonds authorized by the other provisions of this article, the Texas Water Development Board may issue general obligation bonds, at its determination and on a continuing basis, for the economically distressed areas program account of the Texas Water Development Fund II in amounts such that the aggregate principal amount of the bonds issued by the board under this section that are outstanding at any time does not exceed $50 million. The bonds shall be used to provide financial assistance for the development of water supply and sewer service projects in economically distressed areas of the state as defined by law.

(b) The additional general obligation bonds authorized by this section may be issued as bonds, notes, or other obligations as permitted by law and shall be sold in forms and denominations, on terms, at times, in the manner, at places, and in installments, as determined by the Texas Water Development Board. The bonds shall bear a rate or rates of interest the Texas Water Development Board determines. The bonds shall be incontestable after execution by the Texas Water Development Board, approval by the attorney general, and delivery to the purchaser or purchasers of the bonds.

(c) Section 49-d-8(e) of this article applies to the additional general obligation bonds authorized by this section. The limitation in Section 49-d-8 of this article that the Texas Water Development Board may not issue bonds in excess of the aggregate principal amount of general obligation bonds previously authorized for the economically distressed areas program does not apply to the bonds authorized by and issued under this section.

PROPOSITION 3

H.J.R. No. 34 would amend Sec. 2, Art. VIII by adding Subsection (e) to read as follows:

(e) The Legislature by general law may provide that a person who owns property located in an area declared by the governor to be a disaster area following a disaster is entitled to a temporary exemption from ad valor-em taxation by a political subdivision of a portion of the appraised value of that property. The Legislature by general law may prescribe the method of determining the amount of the exemption authorized by this subsection and the duration of the exemption and may provide additional eligibility requirements for the exemption.

PROPOSITION 4

H.J.R. No. 38 would amend Sec. 1(c), Art. VIII, striking out the words as indicated and also amend Art. VIII by adding Sec. 24-a to read as follows:

(c) The Legislature may provide for the taxation of intangible property and may also impose occupation taxes, both upon natural persons and upon corporations, other than municipal, doing any business in this State. The Legislature [Subject to the restrictions of Section 24 of this article, it] may also tax incomes of [both natural persons and] corporations other than municipal. Persons engaged in mechanical and agricultural pursuits shall never be required to pay an occupation tax.

Sec. 24-a. The legislature may not impose a tax on the net incomes of individuals, including an individual’s share of partnership and unincorporated association income.

PROPOSITION 5

S.J.R. No. 24 would amend Art. VIII by adding Sec. 7-d to read as follows:

Sec. 7-d. (a) Subject to Subsection (b) of this section, for each state fiscal year, the net revenue received from the collection of any state taxes imposed on the sale, storage, use, or other consumption in this state of sporting goods that were subject to taxation on January 1, 2019, under Chapter 151, Tax Code, is automatically appropriated when received to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, and is allocated between those agencies as provided by general law. The legislature by general law may provide limitations on the use of money appropriated under this subsection.

(b) The legislature by adoption of a resolution approved by a record vote of two-thirds of the members of each house of the legislature may direct the comptroller of public accounts to reduce the amount of money appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, under Subsection (a) of this section. The comptroller may be directed to make that reduction only:

(1) in the state fiscal year in which the resolution is adopted, or in either of the following two state fiscal years; and

(2) by an amount that does not result in a reduction of more than 50 percent of the amount that would otherwise be appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, in the affected state fiscal year under Subsection (a) of this section.

(c) Money appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, under Subsection (a) of this section may not be considered available for certification by the comptroller of public accounts under Section 49a(b), Article III, of this constitution.

(d) In this section, “sporting goods” means an item of tangible personal property designed and sold for use in a sport or sporting activity, excluding apparel and footwear except that which is suitable only for use in a sport or sporting activity, and excluding board games, electronic games and similar devices, aircraft and powered vehicles, and replacement parts and accessories for any excluded item.

SECTION 2. The following temporary provision is added to the Texas Constitution:

TEMPORARY PROVISION. (a) This temporary provision applies to the constitutional amendment proposed by the 86th Legislature, Regular Session, 2019, dedicating the revenue received from the existing state sales and use taxes that are imposed on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission to protect Texas’ natural areas, water quality, and history by acquiring, managing, and improving state and local parks and historic sites while not increasing the rate of the state sales and use taxes.

(b) Section 7-d, Article VIII, of this constitution takes effect September 1, 2021, and applies only to state tax revenue collected on or after that date.

(c) This temporary provision expires January 1, 2022.

PROPOSITION 6

H.J.R. No. 12 would amend Sec. 67(c), Art. III to read as follows:

(c) The legislature by general law may authorize the Texas Public Finance Authority to provide for, issue, and sell general obligation bonds of the State of Texas on behalf of the Cancer Prevention and Research Institute of Texas in an amount not to exceed $6 [$3] billion and to enter into related credit agreements.

The Texas Public Finance Authority may not issue more than $300 million in bonds authorized by this subsection in a year. The bonds shall be executed in the form, on the terms, and in the denominations, bear interest, and be issued in installments as prescribed by the Texas Public Finance Authority.

PROPOSITION 7

H.J.R. No. 151 would amend Sec. 5(g), Art. VII to read as follows:

(g) Notwithstanding any other provision of this constitution or of a statute, the State Board of Education, the General Land Office, or another [an] entity [other than the State Board of Education] that has responsibility for the management of revenues derived from permanent school fund land or other properties may, in its sole discretion and in addition to other distributions authorized under this constitution or a statute, distribute to the available school fund each year revenue derived during that year from the land or properties, not to exceed $600 [$300] million by each entity each year.

PROPOSITION 8

H.J.R. No. 4 would amend Art. III by adding Sec. 49-d-14 to read as follows:

Sec. 49-d-14. (a) The flood infrastructure fund is created as a special fund in the state treasury outside the general revenue fund.

(b) As provided by general law, money in the flood infrastructure fund may be administered and used, without further appropriation, by the Texas Water Development Board or that board’s successor in function to provide financing for a drainage, flood mitigation, or flood control project, including: (1) planning and design activities; (2) work to obtain regulatory approval to provide nonstructural and structural flood mitigation and drainage; or (3) construction of structural flood mitigation and drainage infrastructure.

(c) Separate accounts may be established in the flood infrastructure fund as necessary to administer the fund or authorized projects.

PROPOSITION 9

H.J.R. No. 95 would amend Art. VIII by adding Sec. 1-p to read as follows:

Sec. 1-p. The legislature by general law may exempt from ad valorem taxation precious metal held in a precious metal depository located in this state. The legislature by general law may define “precious metal” and “precious metal depository” for purposes of this section.

PROPOSITION 10

S.J.R. No. 32 would amend Art. III by adding Sec. 521 to read as follows:

Sec. 521. The legislature may authorize a state agency or a county, a municipality, or other political subdivision to transfer a law enforcement dog, horse, or other animal to the animal’s handler or another qualified caretaker for no consideration on the animal’s retirement or at another time if the transfer is in the animal’s best interest.

This article appeared in The Vindicator's Sept. 26, 2019 edition.

SUBSCRIBE to the print edition of THE VINDICATOR here for as little as 77¢ a week. Or, buy only the e-Edition for as little as 68¢ a week. Subscription rates start at $17.50. THE VINDICATOR has been reporting the local news and sports in Liberty County for over 131 years now, and we've just about gotten the hang of it.